Whether your business is physically in Delaware or not, you don’t pay any state taxes. This is the first method that is typically used to calculate tax. Payment can be submitted with an electronic check or credit card. Since 1981, Harvard Business Services, Inc. has helped form 424,351 Delaware corporations and LLCs for people all over the world. The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurs, startups and general business topics.

Delaware LLCs do not have to complete the annual report, but still pay the $300 Delaware LLC Franchise Tax fee. The State of Delaware allows you to pay the lower of the two Delaware Franchise Tax calculation methods. 7 best church accounting software 2020 Therefore, if you receive a tax bill for tens of thousands of dollars, it may be in your best interest to try calculating your Delaware Franchise Tax with the assumed par value capital method. Your Delaware franchise tax due date depends on the type of business you own. Business that are formed out of state but are registered to do business in Delaware must pay a $125 registration fee.

- The online fee will vary depending on when the online payment is submitted.

- The method is any that recovers more than $1 in tax for ever $1 spent within a four-year period.

- Franchise Tax is the fee imposed by the State of Delaware for the right or privilege to own a Delaware company.

I am going out of business or my business is closed. Do I still owe Delaware franchise taxes?

Foreign corporations, those that are formed outside of Delaware, cannot file online. With this type of business, your business income will be distributed to you as the sole proprietor. You will pay tax to the state on that income on your individual state tax return. The tax rate will depend on your overall taxable income that year. This is not the same as your Delaware annual report and will not mention internal company information, such as director or officer details.

How to Calculate Your Delaware Franchise Tax Fee

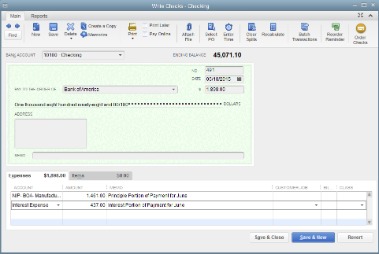

In order to utilize this filing method, you will need to provide the company’s total gross assets (as reported on Form 1120, Schedule L) and the total number of issued shares. The tax is then often calculated to the minimum payment of $400 tax plus the $50 annual report fee, for a total of $450 due per year. The Delaware franchise tax for a corporation is slightly more complicated. It financial statements is based on the corporation type and authorized shares.

What Do I Submit with Payment?

This means that if you receive a high bill that was calculated under the first method, you can request a recalculation what is the allowance method using the second method. The Delaware Franchise Tax and the Registered Agent Fee are two separate, unrelated fees. The annual Franchise Tax is imposed by the State of Delaware and varies with the size of your business.

Or you can go directly to the Delaware Secretary of State franchise tax calculator(s) here. If you’re interested in incorporating your business in Delaware or need to pay your Delaware franchise tax, consider posting a job to receive free custom quotes from one of UpCounsel’s top 5% of attorneys. The annual Registered Agent fee is paid to Harvard Business Services, Inc. for you to act as an agent of your business in the state of Delaware. This is the lowest Registered Agent fee in the industry.

This document certifies the date the company was formed, that the company is current, and that the company is in good standing. You will also be charged a 1.5 percent monthly interest on the amount due. Delaware allows you to pay the lower of the two methods.

Where do I get my total gross assets?

The late fee is $125.00 and a 1.5 percent monthly interest afterward. Owners of multiple corporations will need to pay Delaware Franchise Tax for each entity separately as each entity is required to file an annual report. Failing to pay your franchise tax by March 1st for corporations or June 1st for LLCs will result in a late penalty and interest. After missing the deadline, you’ll need to pay a $200 late fee with cumulative interest each month. You can you learn more here about franchise tax in Delaware.

Both the Delaware annual report and the Delaware franchise tax are due by March 1 each year. Delaware franchise tax is a tax charged by the state of Delaware for the right to own a Delaware company. The tax is required to maintain the company’s good standing in Delaware. Corporations must complete an annual report along with their Delaware Franchise Tax payment.

No corporation shall consolidate with its assets the assets of another entity for purposes of this section. Often, the tax is then calculated to the minimum payment of $350, with a $50 annual report fee. If you pay your Delaware franchise tax late, you’ll be charged a late fee.