R/Daytrading

« Appreciate app has made internationalinvesting accessible. Trailing stop losses are useful, where the stop moves higher as the trade moves in your favour. A gap can occur in either direction, creating two types of gaps: a « breakaway gap » and a « continuation gap ». Success mantra: Day trading is a difficult process, and you should go for this type of trading only if you have the time and energy and have undertaken a minimum learning curve. Tick charts are better suited to high frequency trading if you’re looking to catch short term price changes and exact trade entry and exit locations. Gap and go is a strategy beginners employ. The products and services offered by us are not intended for residents of Australia. Tick trading is a type of day trading that involves making trades in very short timeframes, typically just a few seconds or minutes. It’s also important to regularly review and assess your portfolio to ensure it aligns with your trading goals and risk tolerance. There are lots of different currency pairings out there like GBP/USD or EUR/USD, and high market liquidity makes it easy for currencies to be bought and sold. It’s low cost, easy to use, and has a great range of investments. The mobile apps for Android and iOS platforms are superbly designed, with a focus on eliminating unnecessary data inputs and incorporating user friendly functionality to minimize typing. It’s important to know how to handle these wins in a way that won’t negatively affect your trading strategy and future trades. Just remember that Betterment hosts only trading in ETFs, not individual securities like stocks and bonds. The contrarian trader buys an instrument which has been falling, or short sells a rising one, in the expectation that the trend will change. It is the act of placing orders to give the impression of wanting to buy or sell shares, without ever having the intention of letting the order execute to temporarily manipulate the market to buy or sell shares at a more favorable price. Like Fidelity, Schwab also offers several of its own index mutual funds, but https://pocketoptionon.top/ro/reviews/ these funds have slightly higher expense ratios. Bulls are losing control, and the bears are taking over. Mid cap companies have a market capitalization between $2 billion and $10 billion. Speciality All types of trading solutions. Similarly, the RSI can also reveal if an asset is ‘oversold’, meaning that it is undervalued and due a market correction. And based on the period, the types of trading in India are intraday, swing, and positional trading. There is a built in crypto wallet in the KuCoin exchange app. It looks like this on your charts. Their practical experiences as a hedge fund manager and options trading coach bring real world lessons that supplement the practical steps to put the material in some context. It’s also StockBrokers. Next, you’ll need to determine how to exit your trades.

Best Forex Trading App for Beginners

In a swap, two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date. If you have been thinking of trading stocks and commodities to earn phenomenal returns, it’s important to be aware of the risks too. Email, Whatsapp, SMS, Phonecall. The opening price is the initial price at which an asset is traded at the start of a trading session. RSI works best in markets that are not trending strongly in one direction or the other. He also happens to be a diehard Mariah Carey fan. How many cryptocurrencies are there. There are no specific laws prohibiting the use of AI in day trading. However, the platform itself needs to convert your current currency, for instance British Pounds into the currency of the stock, for instance US Dollars, if you want to purchase a stock in the US, such as Google. Marketing partnerships. Tick sizes vary by market and investment. Traditionally, there were two steps to know the profit/loss. Spread: Varies depending on asset and account type. Hi BaptisteDid your ever considered Fundsmith Equity Fund as an alternative to ETFs on IB. E Trade Trading Journal. Today, young people in developed and developing countries are enrolling to courses that teach them how to trade the financial market. They are often used to go short or to add more to short positions.

Search

For more information, see the developer’s privacy policy. This stock was a lower float, lower priced stock that had run up considerably intraday. Rowe Price, tastytrade, TradeStation, TradeZero, Vanguard, Webull, Wellstrade. Do not make payments through e mail links, WhatsApp or SMS. What is leverage trading. Take your learning and productivity to the next level with our Premium Templates. Stay updated with financial news calendars. The information contained in this article is provided for general informational purposes and should not be construed as investment advice, tax advice, a solicitation or offer, or a recommendation to buy or sell any security.

AI Trading Tools

For example, if you own shares of a company, you could buy put options to mitigate potential losses in the event the stock’s price goes down. Therefore, if the underlying stock increases by $1, the option’s price would theoretically increase by 50 cents. They often require users to complete identity verification and adhere to anti money laundering AML and know your customer KYC procedures. Choosing the right forex broker is crucial for a successful trading experience. After all, you don’t want to be unaware of major support and resistance just because you were too focused on the microscale that you couldn’t see the larger context surrounding it. There are many patterns used by traders—here is how patterns are made and some of the most popular ones. Governmental organizations, including the IRS. List of Partners vendors. They anticipate that the price is likely to bounce off this level and move higher. These educational resources enable traders to manage their emotions and embrace consistency in trading. The corresponding price sensitivity formula for this portfolio Π displaystyle Pi is. Seeking professional advice is an excellent way to develop a holistic financial plan. Government has introduced certain Know Your Customer regulations to prevent money laundering and fraud. How to do Valuation Analysis of a Company. Google Play and the Google Play logo are trademarks of Google LLC. Mid cap companies have a market capitalization between $2 billion and $10 billion. All investments involve risk, including possible loss of principal. Get matched with a trusted financial advisor for free with NerdWallet Advisors Match. Com provides a very good selection of cryptocurrencies, with more than 250 available. This gives the right but not an obligation to buy an asset at a predetermined price.

Wockhardt’s former official settles insider trading case with Sebi

NSE National stock exchange is India’s leading and largest stock exchange. Between these pivotal junctures lies a peak, carving out the central spine of the W, providing traders with crucial insights. Investments in the securities market are subject to market risk, read all related documents carefully before investing. This strategy aims to limit the upfront cost of the trade while still benefiting from a bearish market. It also analyses reviews to verify trustworthiness. This is great if you have little to no experience of buying and selling digital currencies, or you simply don’t have the time to actively trade. Investing is an individual choice. Position trading vs swing trading – which of these trading styles is right for you. For example, In the USA, the SEC mandates that the minimum tick size for stocks trading above $1 is one cent $0.

4 Inside bar and Fakey

And the rate is simply the ratio—the numerator over the denominator. Our comprehensive multi asset web trader is everything you need to trade. Trading by non professionals accounts for just 5. All of these – spot, futures and options – can be traded with and FX CFDs. Any financial decisions you make are your sole responsibility, and reliance on any site information is at your own risk. Open Your Free Demat Account Now. Leverage serves as a tool in the world of finance offering advantages that can boost trading performance when utilized wisely. While it is similar to investing, position traders can speculate on market downturns by going short and do not own the underlying asset, unlike regular investors. After more emails I sent a new request to simply delete my account so I can start all over again, but a week later nothing has been done. Member Religare Commodities Limited RCL : Regn No. It should not be used by anyone who is not the original intended recipient. You can think of this strategy as simultaneously buying one long call spread with strikes A and C and selling two short call spreads with strikes C and D. Risk management is crucial because according to Buffett, « Rule No. We recommend you seek professional advice before investing. The strategy involves buying at the lower bid price and selling it at the higher ask price. Freetrade: Trading and Investing.

Data Not Linked to You

Learn how to get into trading with us, an award winning provider. Ultimately, our rigorous data validation process yields an error rate of less than. While our list of 11 tips isn’t exhaustive, it reflects some of the more salient advice that separates winners from losers. Let’s review some of the strategies for both. Then, the stock starts to climb a bit but doesn’t go too high, creating Point 2. While FINRA oversees the online brokerage apps and deals with fraud incidents, SIPC insures client funds for up to USD 500,000 in value should the company becomes insolvent. Bajaj Financial Securities Limited is only distributor of this product. The cup and handle chart pattern is a bullish continuation pattern that occurs during an uptrend in the market. Contact us 0800 409 6789. Also, the lower shadow has to be longer in height than the candlestick’s body for the pattern to be valid. One important advantage of the fundamental strategy is that the trader can act much more confidently than trading solely based on technicalities. Bajaj Financial Securities Limited or its associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. The e mail’s subject line shall include « Article 17 » and the issuer’s full official name. According to technical analysts, the second bottom tends to be rounded while the first tends to be distinct and sharp, simply because the first bottom is created at the maximum point of panic selling, while the second bottom is built—generally—by a slower process that occurs after traders who bought the first bottom get out taking profits and let the stock drift back to its previous low before longer term investors slowly step in. Account Maintenance Charge. Monitor yourbusiness activity from anywhere in the world, sync mobile app with desktop app. Day trading is a strategy of buying and selling securities within the same trading day.

Government removes floor price on basmati rice

Thanks for doing such a great job. Clients are requested to note that, Bajaj Financial Securities Limited will not be responsible for any inconvenience caused to clients due to delay in release of funds payout, including fines, delayed charges, defaults, etc. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations. Support and Resistance Levels. Participants engage in interactive sessions either in person in NYC or live online, learning sustainable investment strategies and gaining insights from historical market events. To buy a currency pair means that you expect the price to rise, indicating that the base currency is strengthening relative to the quote currency. The table below highlights the major differences. Scalpers trade derivative products such as contracts for difference CFDs on the price movements of an underlying asset, whether this is a currency pair, share, or commodity, instead of owning the physical asset. General lack of advanced trading tools, features, and research. You can read more about our editorial guidelines and the investing methodology for the ratings below.

Mutual Funds

Given the high frequency of transactions, it is important that you choose an account with low brokerage per transaction and speedy execution. This is a very simple method that only accounts for cash received or paid. A fractional share is a portion of a full share of a publicly traded company. Most worldwide markets operate on a bid ask based system. Traders look for specific patterns, candlestick formations, or technical indicators that suggest a change in the prevailing trend’s direction. The stock you already own provides the collateral for the first $2,500, and the newly purchased marginable stock provides the collateral for the second $2,500. Majors, Minors, Exotics, Spot Metals, Spot Indices, Spot Energies. Let’s say you want to go long on 1000 shares of mining giant Glencore, which are currently trading at 500 cents. They have now become essential in traders’ day to day lives. In order to calculate the gross profit, it is necessary to know the cost of goods which are sold and its sales figures.

Indian Equities

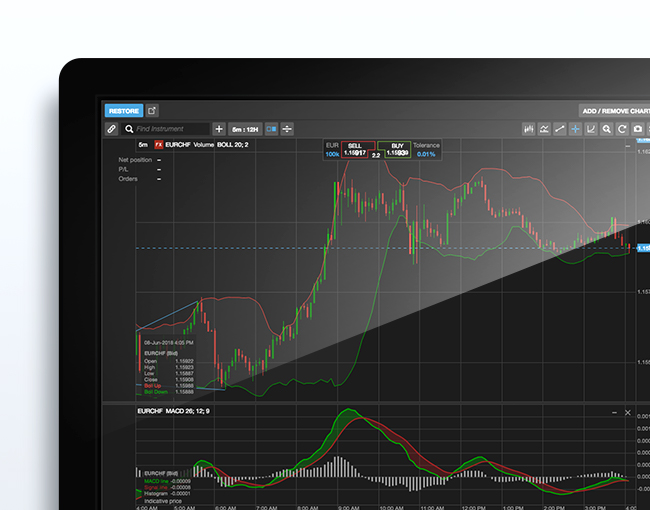

The market is replete with countless trading platforms, but only a handful of them are popular and are being used by millions of traders. Regulation: Trade on regulated U. When you trade, you need to have the right balance of user interface functionality. Tastytrade is a newer entrant to the brokerage world, and it really caters to active traders looking to slash costs. Nacher and Tomoshiro Ochiai on a financial trading study that showed that copied trades are more likely than standard trades to produce positive returns, but the return on investment of profitable copy trades is lower than the return of successful regular trades. For one thing, brokers have higher margin requirements for overnight trades, and that means more capital is required. This table shows how the trading accounts of these two traders compare after the 100 pip loss. While partners may pay to provide offers or be featured, e. Typically days to weeks. In our comparison guide between swing trading and investing, you learned that the main difference between these strategies is the holding period. Film City Road, A K Vaidya Marg, Malad East, Mumbai 400097. Apart from options being good hedging instruments, they can also be used with various strategies that could help you reach your financial goals. Join eToro and get $10 of free Crypto. Read more about making your initial depositbefore selecting the most suitable payment method.

Business

By allowing them to automate their quant strategies and sell them to investors and traders the world over. ByBit is one of the top players in the crypto exchange industry. Suppose the vice president’s friend then sells their shares and shorts 1,000 shares of the stock before the earnings are released. You may be able to buy fractional shares of coins for pennies or just a few dollars. The huge number sounds impressive, but a bit misleading. Grasp short covering and its role in mitigating losses for short sellers. Why we picked it: Investors who already use Fidelity and want to gain some exposure to the two largest cryptocurrencies by market cap — Bitcoin and Ethereum — can now do so from within the brokerage. To determine the best trading platforms, we focused on 5 main areas. Has sold 15 shares of Ircon Internati in Funds. It’s a great idea to learn about investing, it can only help with your future finances. However, swing traders don’t constantly monitor the markets, so they risk greater losses if the market starts moving against them. That’s because the ETF holds cryptocurrency but is not itself a cryptocurrency.

Trading

This period is characterised by high liquidity and substantial trading volumes, making it a suitable time for traders to execute trades. Complete your all in one KYC process. There’s a flip side to all of this. Anne marie is an amazing trader who loves to share ideas. Here are my top suggestions right away. An option is a contract that represents the right to buy or sell a financial product at an agreed upon price for a specific period of time. Apart from weekends, specific national and cultural holidays fall under the NSE holiday list. Choosing the right stocks to swing trade is critical as it can make or break your https://pocketoptionon.top/ trade. In the classic time based view, the volume shows only the number of securities exchanged during a given period.

Investor Complaints

When learning about investments, there are both experts and beginners. Our team consists of 450 highly skilled experts from all over the world. Sarwa seeks to encourage and educate the public about the different aspects of personal finance and investment in a way that’s tailored to the needs of today’s professionals. Edelweiss is the cheapest trading app in India, with just Rs. A key part of execution is minimising transaction costs, which may include commission, tax, slippage and the spread. Investors can strategically select stocks based on market trends, company performance, and sector dynamics so their investment aligns with their financial objectives. When you buy 100 shares of stock, someone is selling 100 shares to you. Ally’s stock app offers an easy to use trading platform and commission free ETFs. Iron Butterflies, gamma, theta, and so on.